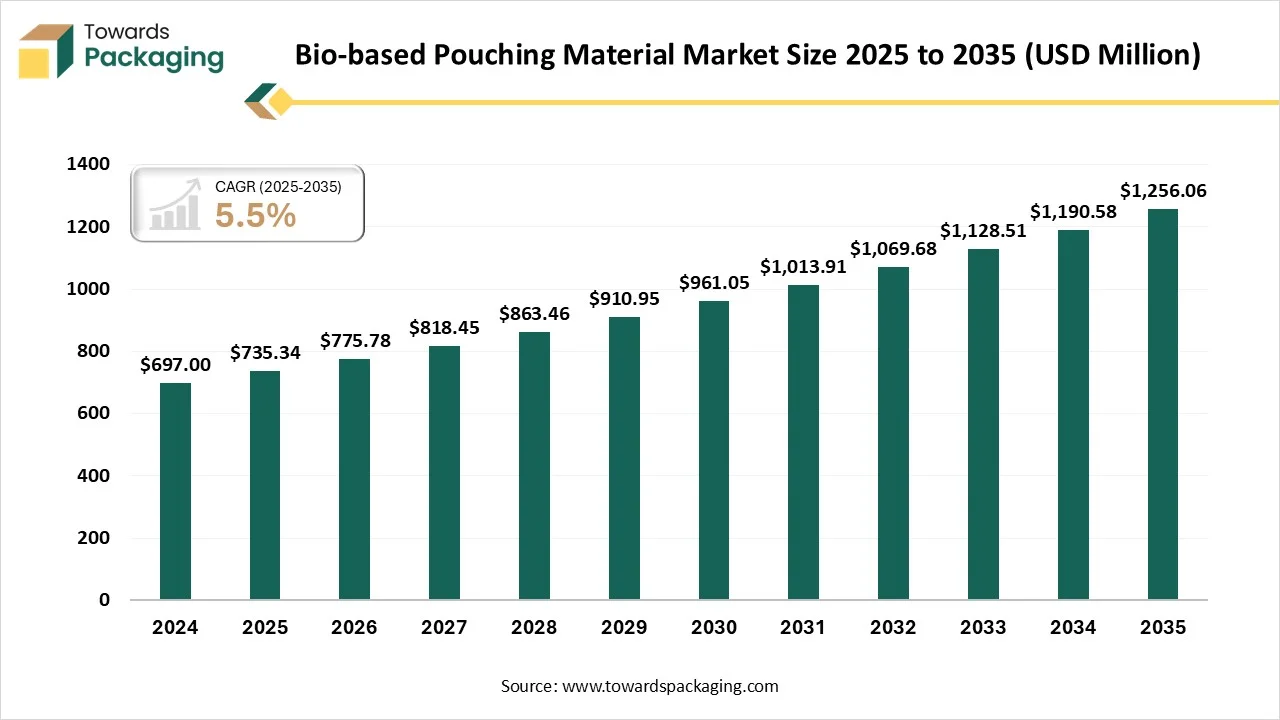

Ottawa, Jan. 23, 2026 (GLOBE NEWSWIRE) -- The bio-based pouching material market is forecasted to expand from USD 775.78 million in 2026 to USD 1256.06 million by 2035, growing at a CAGR of 5.5% from 2026 to 2035. The market is experiencing rapid growth, driven by increasing demand for sustainable packaging in the food, beverage, cosmetics, and household goods sectors. According to data published by Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by the Bio-based Pouching Material?

The bio-based pouching material refers to the industry segment focused on producing and utilizing flexible packaging made wholly or partly from renewable biological resources, such as corn starch, sugarcane, cellulose, or agricultural waste, as an alternative to traditional petroleum-based plastics. The primary goal is to provide sustainable packaging solutions with a lower environmental impact and reduced dependence on fossil fuels.

Private Industry Investments for Bio-based Pouching Materials:

- TIPA has received significant funding, including a $70 million Series C round, to develop a wide range of biodegradable, recyclable, and compostable packaging solutions, including films, laminates, and pouches.

- Fibmold secured $10 million in Series A funding from investors like Omnivore to manufacture packaging products, including those suitable for food, pharma, and beauty industries, from natural fibers and agricultural waste.

- Shellworks, a biotech startup, raised over $7 million in seed funding to create sustainable biopolymer products from waste crustacean shells that are home-compostable and plastic-free alternatives.

- Kelpi uses seaweed to create bioplastic packaging and recently secured over $5.5 million from venture capital firms to scale its technology and replace multi-layer plastic packaging in various applications, including food trays.

- Bambrew raised more than $7 million in equity and debt funding to expand production of green packaging for fast-moving consumer goods brands using materials like bamboo, addressing the rising demand for sustainable solutions in Asia.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5928

What Are the Latest Key Trends in the Bio-based Pouching Material Market?

- E-commerce Growth: Rising online shopping fuels demand for sustainable pouches for delivery and product protection.

- Material Innovation: Development of advanced bio-polymers and natural materials improves functionality and biodegradability, replacing traditional plastics.

- Regulatory Push: Government policies against single-use plastics and corporate sustainability targets accelerate adoption.

What Is the Potential Growth Rate of the Bio-based Pouching Material Industry?

The growth of the bio-based pouching material industry is driven by growing environmental concerns and consumer demand, which increases awareness and also pushes consumers towards the use of eco-friendly products. The stringent regulations and technological advancements for improving the performance, durability, and barrier properties of bio-based materials make them suitable for use in various industries, driving the growth and expansion of the market.

Regional Analysis:

How Did Europe Dominate the Bio-based Pouching Material Market?

Europe dominated the market, accounting for the largest share of 42.5% in 2025, characterized by stringent environmental policies and circular economy mandates. Strong collaboration between packaging producers and material developers accelerates the commercialization of advanced bio-based structures.

Germany: Bio-based Pouching Material Market Growth Trends

Germany stands out as a key European market due to its advanced packaging industry and strong regulatory compliance culture. The country emphasizes recyclable and bio-based flexible packaging solutions, particularly in food and industrial applications. High consumer awareness, coupled with innovation in bio-polymer films and multilayer pouching materials, reinforces Germany’s leadership position.

How did the Rapid Expansion of Industries Support the Growth of the Bio-Based Pouching Material Industry in the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR over the forecast period, driven by the rapid expansion of flexible packaging, rising environmental awareness, and a strong regulatory push toward sustainable material. Cost-competitive manufacturing, availability of agricultural feedstocks, and growing urban consumption further support regional market expansion.

China Bio-based Pouching Material Market Growth Trends

China plays a pivotal role within the Asia Pacific due to its massive packaging industry and increasing government focus on biodegradable and renewable materials. Investments in bio-polymer processing technologies and domestic production capacity strengthen China’s market position.

More Insights of Towards Packaging:

- Polycarbonate Sheet Market Trends and Global Production Volumes for 2026-2035

- Biodegradable Plastic Films Market Strategic Growth, Innovation & Investment Trends 2026-2035

- Certified-Circular Polyethylene (PE) Market Size and Segments Outlook (2026–2035)

- High-Quality Rigid Packaging Materials Market Size, Trends and Regional Analysis (2026–2035)

- Molded Pulp Packaging Market Size, Trends, Segments, Regional Outlook & Competitive Landscape Analysis

- Peelable Lidding Films Market Size, Trends and Competitive Landscape (2026–2035)

- Foam Protective Packaging Market Size, Share, Trends, and Forecast Analysis (2025-2035)

- Solid Bleached Sulfate (SBS) Board Market Size, Trends and Regional Analysis (2026–2035)

- PP Deli Food Container Market Size, Trends and Regional Analysis (2026–2035)

- Plastic Tubes Market Size, Trends and Competitive Landscape (2026–2035)

- Cork Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Medical Flexible Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Blood Glucose Test Strip Packaging Market Size and Segments Outlook (2026–2035)

- Aseptic Packaging for Non-Carbonated Beverages Market Size and Segments Outlook (2026–2035)

- Aluminum Tubes Market Size, Trends and Competitive Landscape (2026–2035)

- Shaped Corrugated Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Rigid IBC Market Size and Segments Outlook (2026–2035)

- Old Corrugated Container Market Size, Trends and Competitive Landscape (2026–2035)

- Luxury Rigid Box Market Size, Trends and Regional Analysis (2026–2035)

- Corrugated Bulk Bin Market Size, Trends and Segments (2026–2035)

Segment Outlook

Material Type Insight

How Did the Bio-PE/ Bio-PET Segment Dominated the Bio-Based Pouching Material Market In 2025?

The bio-PE / bio-PET segment dominated the market with a share of 34.4% in 2025 due to its compatibility with existing plastic processing infrastructure and recycling streams. Strong adoption is observed in food, beverage, and personal care packaging, where brand owners prioritize drop-in sustainable alternatives without compromising performance.

The PHA & PLA blends segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, since they are fully or partially biodegradable biopolymers increasingly used in compostable pouching materials. These materials are favored in applications targeting environmental compliance and circular economy goals. However, cost, thermal stability, and moisture sensitivity continue to influence their adoption across high-barrier packaging formats.

Pouch Type Insight

Which Pouch Type Segment Dominated the Bio-Based Pouching Material Market In 2025?

The stand-up pouches segment dominated the market with a share of 31.4% in 2025, due to their lightweight design, shelf appeal, and efficient material usage. Demand is particularly strong in food, beverage, and nutraceutical segments, where flexible packaging formats enable extended shelf life, branding flexibility, and reduced transportation emissions.

The spout pouches segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, due to their convenience, resealability, and suitability for liquid and semi-liquid products. However, achieving adequate barrier performance and sealing strength using biobased materials remains a key technical focus area for manufacturers.

Barrier Performance Insight

How Did the High-Barrier Laminated Films Segment Dominated the Bio-Based Pouching Material Market In 2025?

The high-barrier laminated films segment dominated the market with a share of 53.8% in 2025, since they are used where oxygen, moisture, and light protection are critical, particularly in food and pharmaceutical applications. Although performance levels are improving, balancing biodegradability with barrier efficiency remains a challenge, influencing material selection and multilayer design strategies.

The medium-barrier co-extruded films segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, since they are widely used in applications with moderate shelf-life requirements. Their simpler structure supports recyclability and sustainability compliance, making them attractive for brands transitioning from conventional plastics to biobased alternatives without significantly increasing packaging complexity.

End-Use Industry Insight

Which End Use Industry Segment Dominated the Bio-Based Pouching Material Market In 2025?

The food & beverages segment dominated the market with a share of 35.8% in 2025, driven by regulatory pressure, consumer preference for sustainable packaging, and brand sustainability commitments. Performance requirements such as shelf life, safety, and sealing integrity continue to shape material innovation in this segment.

The pharmaceutical & nutraceutical segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, as they are adopted for supplements, powders, and medical nutrition products. Growth is supported by rising demand for eco-friendly healthcare packaging, although stringent validation requirements and performance consistency remain critical considerations for broader adoption.

Application/Use-Case Insight

How Did the Ambient Shelf Pouches Segment Dominated the Bio-Based Pouching Material Market In 2025?

The ambient shelf pouches segment dominated the market with a share of 37.8% in 2025, since they are widely applied in products that do not require thermal processing, such as dry foods, snacks, and nutritional powders. Cost efficiency and sustainability labeling are key drivers supporting adoption in this use case.

The retort/sterilized food pouches segment is projected to grow at the fastest CAGR between 2026 and 2035 in the market, as they represent a technically demanding application for biobased materials due to high temperature and pressure exposure. Growth in this segment is gradual, driven by innovation aimed at balancing thermal stability with environmental performance.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Recent Breakthroughs in the Bio-Based Pouching Material Industry

- In November 2025, Storopack launched a new polyurethane foam packaging solution called FOAMplus® 7008-BIO, which contains over 83% bio-based carbon content. This foam product is also available paired with a certified bio-based film.

- In August 2025, the Otrivin brand nasal spray pump from Haleon was launched with 52% ISCC Plus certified bio-based material, which is derived from renewable sources like bio-waste and residual oils using a mass balance approach.

Top Companies in the Bio-Based Pouching Material Market & Their Offerings:

- Huhtamaki: Offers the Blueloop™ range of mono-material and bio-based laminates designed for high-barrier food and personal care pouches.

- Sealed Air: Produces CRYOVAC® compostable and plant-based resin films focused on liquid and food packaging applications.

- Uflex: Manufactures Flexfresh™ compostable films and Asclepius™ PCR-based films to reduce plastic waste in flexible packaging.

- Taghleef Industries: Produces NATIVIA® bio-based PLA films and bioPP options derived from renewable, mass-balanced feedstocks.

- Futamura: Specializes in NatureFlex™, a range of cellulose-based films made from wood pulp that are fully home and industrial-compostable.

- NatureWorks (Ingeo PLA): Supplies Ingeo™ biopolymer resins used to create high-clarity, compostable pouch layers with a low carbon footprint.

- Corbion: Provides Luminy® PLA resins that enable heat-resistant, bio-based pouching solutions suitable for food contact.

- Innovia Films: Offers Encore and Rayoface™ films featuring renewable content and high-barrier performance for sustainable pouches.

- Novamont: Develops Mater-Bi® bioplastics, which are widely used to create biodegradable and compostable films for food and waste pouches.

- Mitsubishi Chemical / MPP: Manufactures Hostaphan® sustainable polyester films, including grades with bio-based content and high recycled material.

- Huhtamaki Specialty Films: Delivers specialized paper-based and bio-polymeric laminates aimed at replacing traditional multi-layer plastics.

- BASF: Supplies ecovio®, a compostable biopolymer blend used for high-performance flexible films and certified compostable bags.

Segment Covered in the Report

Material Type

- Polylactic Acid (PLA)

- Bio-PE / Bio-PET (drop-in bio-based polyolefins/polyesters)

- PHA (Polyhydroxyalkanoates)

- Starch-based blends

- Cellulose-based films (e.g., regenerated cellulose)

- PBAT / biodegradable blends (bio-based content blends)

Pouch Type

- Stand-up pouches

- Spout pouches

- Zipper / resealable pouches

- Flat / lay-flat pouches

- Retortable pouches

Barrier Performance

- High-barrier laminated films

- Medium-barrier co-extruded films

- Breathable/permeable films

End-use Industry

- Food & Beverage

- Pharmaceuticals & Nutraceuticals

- Personal Care & Cosmetics

- Household & Home Care

- Pet Food & Animal Feed

Application / Use-case

- Ambient shelf pouches

- Frozen/chilled product pouches

- Retort / sterilized food pouches

- Snack & confectionery pouches

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5928

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

- Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- High-Performance Blown Stretch Film Market Size, Trends and Competitive Landscape (2026–2035)

- L-Sealer Machine Market Size, Trends and Regional Analysis (2026–2035)

- Packaging Coatings Market Size, Segments, Companies, Competitive Analysis, Value Chain & Trade Analysis 2026-2035

- Pharmaceutical APET Film Market Size, Trends and Competitive Landscape (2026–2035)

- PET VCI Shrink Film Market Size, Trends and Regional Analysis (2026–2035)

- Electronics APET Film Market Size, Trends and Regional Analysis (2026–2035)

- Specialty Shipping Containers Market Size, Trends and Segments (2026–2035)

- Recycled Aluminum Cans Market Size, Trends and Regional Analysis (2026–2035)

- Plant-Based Food Bioplastics Market Size and Segments Outlook (2026–2035)

- IC Packaging and Testing Market Size and Segments Outlook (2026–2035)

- VCI Anti-corrosion Film Market Size and Segments Outlook (2026–2035)

- Molded Tableware Products Market Size and Segments Outlook (2026–2035)

- Duplex Paper and Board for FMCG Market Size, Trends and Regional Analysis (2026–2035)

- Tablet Inspection and Printing System Market Size, Trends and Competitive Landscape (2026–2035)

- Plastic Tray Market Size and Segments Outlook (2026–2035)

- IV Fluid Bags Market Size and Segments Outlook (2026–2035)

- Automated E-Commerce Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Reverse Tuck Box Market Size and Segments Outlook (2026–2035)

- Recycled Polyethene for Sustainable Flexible Packaging Market Size, Trends and Segments (2026–2035)

- Barrier Coating for Recyclable Flexible Packaging Market Size, Trends and Segments (2026–2035)