HONG KONG, Dec. 05, 2025 (GLOBE NEWSWIRE) -- CoinEx Research’s November 2025 Report: Painvember is a brutal reality check after Uptober’s euphoric highs. Profit-taking by long-term holders, sustained ETF outflows, and cascading liquidations drove the downturn, all against a risk-off macro backdrop. While the Fed’s late-month dovish pivot and progress on the Ukraine–Russia peace framework briefly improved liquidity expectations, sentiment deteriorated again due to China reaffirming its crypto ban, S&P Global downgrading USDT, and rising Japanese yields threatening a yen carry-trade unwind. Beyond Bitcoin, AI and prediction-market sectors saw heightened volatility but also meaningful innovation and on-chain activity, while stablecoin flows printed their weakest reading in nearly a year, a key inflection point that may determine whether crypto enters a short-term correction or a new multi-month bear cycle.

From Euphoria to Exhaustion: The Toughest Month of 2025

Following a fresh new high in early October, where Bitcoin peaked around $126,000, the momentum of "Uptober" dissipated rapidly, giving way to intense selling pressure throughout November. The asset plunged to a low of $80,500 before closing the month at $90,300, marking a 28% drawdown from its all-time high. This correction was fueled by profit-taking from OG whales, significant outflows from Bitcoin ETFs, and a wave of cascading liquidations, all amplified by a broader risk-off sentiment in the macroeconomic environment.

On the macro side, the Federal Reserve shifted toward a more dovish stance late in the month, with market-implied odds of a 25-basis-point rate cut on December 10 climbing to 85%. This development, alongside progress in Ukraine-Russia peace negotiations, offered a glimmer of optimism for improved liquidity conditions in crypto markets. However, sentiment soured toward month-end amid several headwinds: China reaffirmed its stringent crypto ban, S&P Global downgraded Tether's USDT to its lowest "Weak" stability rating, rekindling concerns over stablecoin vulnerabilities, and rising Japanese government bond yields signaled a potential acceleration in the yen carry-trade unwind, pulling liquidity out of risk assets like Bitcoin.

In our view, as crypto becomes increasingly institutionalized, macroeconomic factors will play an outsized role in dictating price action. For Bitcoin to avert a deeper bear phase, it must defend the critical $80,000–$82,000 support zone amid ongoing volatility.

Key Charts to Watch

BTC has remained weak this month, dipping to around $80k before rebounding. However, the overall rebound lacks strength and is highly likely to retest the $80k zone. A break below could lead to a decline toward the next key support at $73k.

$ZEC failed to sustain its prior strength and retraced into a demand zone. As a move driven by fundamentals & spot demand, $ZEC’s current cycle may not yet be over—closely monitor price action at the support level.

The AI Infrastructure Throne is Shaking

In November, the AI sector presented a complex landscape of strong fundamentals yet escalating competition. The chip behemoth NVIDIA delivered better-than-expected earnings, but its stock price experienced significant volatility due to news that Meta plans to shift towards Google TPU chips. This sparked market concern that the monopolistic structure of AI infrastructure might be loosening. On the model front, Google formally released its flagship model, Gemini 3 Pro, boasting a 1M token context window and powerful multimodal capabilities, solidifying its position in the model arms race. Notably, China's Moonshot AI Lab also launched its kimi-k2-thinking model this month. This model, which utilizes a Mixture of Experts (MoE) architecture, achieves high-performance inference at extremely low training costs. This marks an intensification of the global open-source AI model competition, providing the decentralized AI community with a new low-cost, high-efficiency model option.

AI Bubble FUD Spills Over

The volatility in the stock prices and valuations of AI giants directly impacted the cryptocurrency market through the risk sentiment transmission chain. As high-beta core assets of the US tech sector, the short-term correction in AI concept stocks triggered a broader sell-off in "Risk-On Assets." This stock-crypto market linkage was prominent in November: the decline of market leaders like NVIDIA heightened fears of an AI bubble, subsequently leading to selling pressure on the crypto market near critical price points.

Crypto AI Projects also Cooking

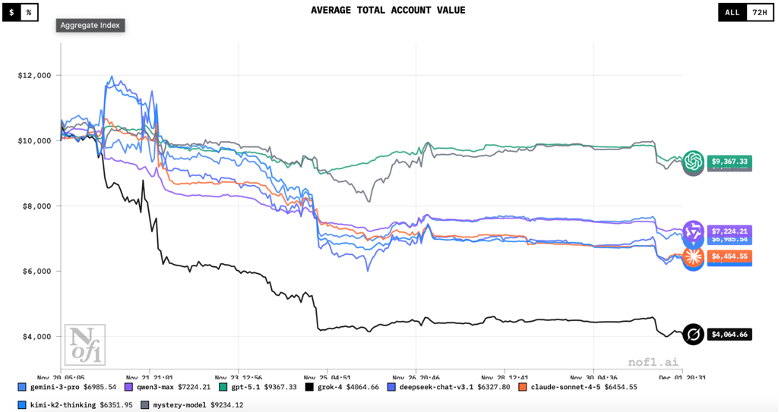

The cryptocurrency AI track remained highly active and innovative in November. Infrastructure leader Bittensor (TAO) continued to expand its subnet ecosystem and attracted institutional capital through an ETP listing in the European market, with market focus shifting to its first halving mechanism in December. In terms of compute power, Render (RNDR) officially launched its Compute Subnet, transitioning into a pure AI inference computing network. The application and agent layers saw real-world stress testing: nof1.ai's Alpha Arena Season 1.5 commenced, deploying $320,000 in real capital, pitting multiple AI models, including Gemini 3 Pro and kimi-k2-thinking, against each other in real-time cryptocurrency and US stock token trading on the Hyperliquid DEX, directly placing the AI models' investment judgment capabilities in a competitive arena.

Prediction Markets Enter Normalized High-Liquidity Era

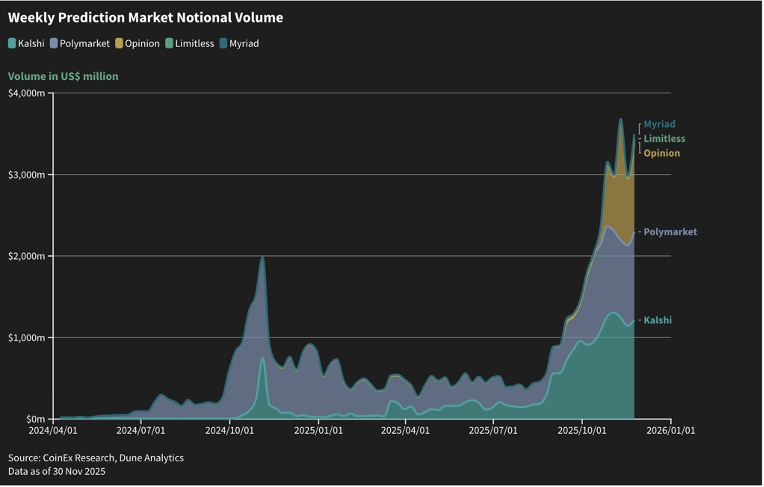

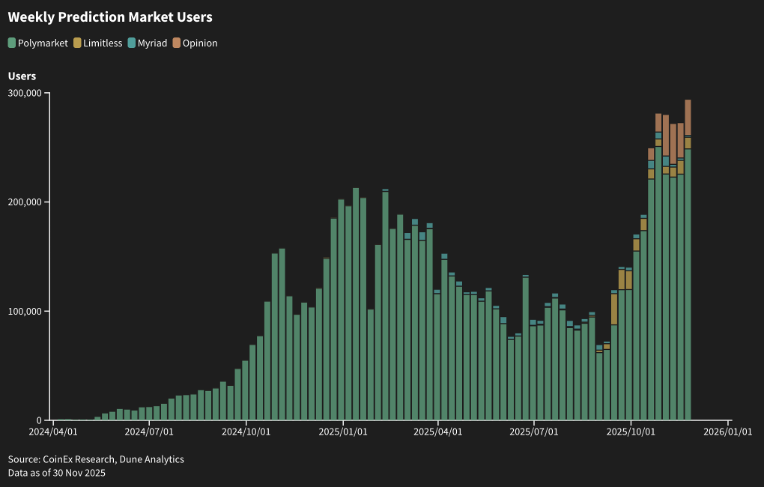

The prediction market’s weekly volume exceeded $3.6 billion in November, significantly surpassing the 2024 election peak. In our view, the market has successfully transitioned from an "event-driven" model to a phase of "normalized high liquidity."

Polymarket maintains its stable retail user base, while Kalshi, leveraging compliance and institutional capital, has caught up to and, in periods, overtaken Polymarket in transaction volume. The Monad-based Opinion protocol surged in Q4, rapidly capturing a significant market share and challenging the established duopoly.

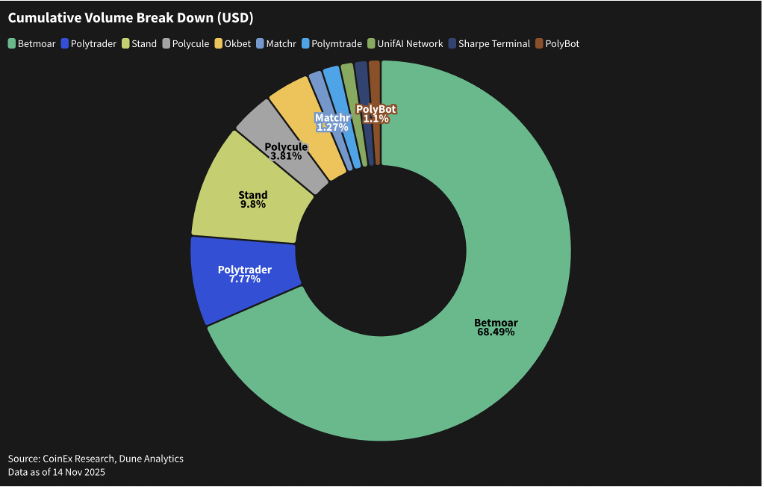

Polymarket Builders Ecosystem: High Concentration & Strategic Value

Extreme Volume Concentration: The Builders program has created a highly concentrated structure, with Betmoar dominating the ecosystem by capturing an astonishing 68.49% of all third-party front-end transaction volume. This highlights an "extreme head effect" driven by superior UX or specific incentives.

Tier 2 Differentiation: The second tier, led by Standtrade (9.8%) and Polytraderpro (7.77%), proves that specialized interfaces (e.g., Pro tools for traders) still hold significant volume and room for differentiated competition.

Strategic Long Tail: The remaining volume (~14%) is held by long-tail projects (like Polycule and Matchr.xyz). Though small, these independent front-ends are critical to Polymarket's overall censorship resistance and global market penetration.

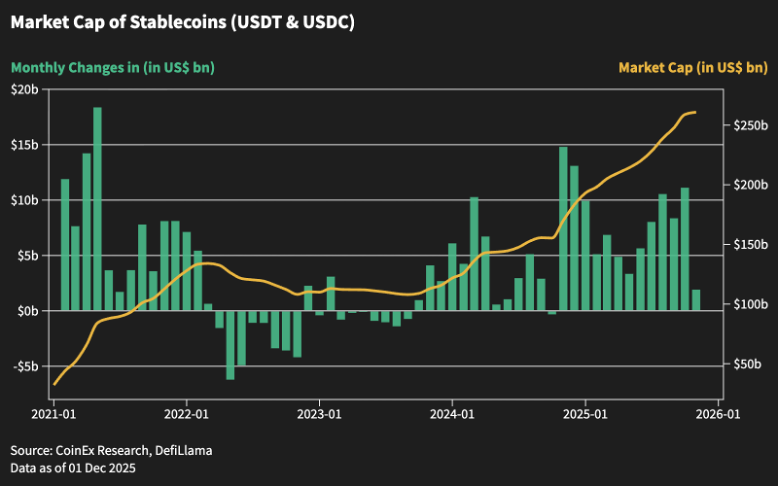

Stablecoin Flows Just Printed the Most Bearish Bar in a Year

Stablecoin inflows have slowed significantly, with the next period's data being extremely critical. This month, stablecoins continued to see inflows, but the volume has slowed markedly, reaching the lowest level ($1.9B) in nearly a year.

The next period's data is highly critical and could lead to two possible scenarios:

- Bull Case: stablecoin inflows do not continue to weaken and may even maintain slight growth. In this case, the current adjustment could end within a quarter (similar to the market in May 2024).

- Bear Case: stablecoin flows shift to significant outflows, with capital accelerating its exit. This could signal a bear market cycle lasting at least 6 months (similar to April 2022).

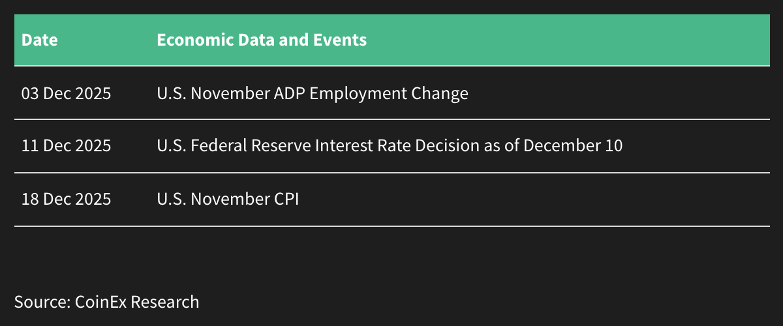

Economic Data & Events to Watch in December 2025

About CoinEx

Established in 2017, CoinEx is an award-winning cryptocurrency exchange designed with users in mind. Since its launch by the industry-leading mining pool ViaBTC, the platform has been one of the earliest crypto exchanges to release proof-of-reserves to protect 100% of user assets. CoinEx provides over 1400 coins, supported by professional-grade features and services, for its 10+ million users across 200+ countries and regions. CoinEx is also home to its native token, CET, incentivizing user activities while empowering its ecosystem.

To learn more about CoinEx, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

Contact:

CoinEx

pr@coinex.com

Disclaimer: This content is provided by CoinEx. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice. Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions. Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/9e1da8b6-4245-43ed-bd33-71ada1f2af5f

https://www.globenewswire.com/NewsRoom/AttachmentNg/ae3f9775-27c7-49ec-adae-2bea52cc06ee

https://www.globenewswire.com/NewsRoom/AttachmentNg/fa704ae3-e4bf-43ec-92c6-5cf4cad50055

https://www.globenewswire.com/NewsRoom/AttachmentNg/2f2e00b5-f136-48d3-9692-24fd2e090580

https://www.globenewswire.com/NewsRoom/AttachmentNg/60bdd98d-6182-4960-92ec-2818699570d9

https://www.globenewswire.com/NewsRoom/AttachmentNg/3b8d76f0-605e-4531-b3c8-184c0624ea10

https://www.globenewswire.com/NewsRoom/AttachmentNg/8b8736c5-5e08-4cfa-827b-4f0274c8358a

https://www.globenewswire.com/NewsRoom/AttachmentNg/80c85759-b0ce-424d-b36b-6695af8361cb