TORONTO, Feb. 18, 2026 (GLOBE NEWSWIRE) -- Lahontan Gold Corp. (TSXV:LG, OTCQB:LGCXF, FSE:Y2F) (the "Company" or "Lahontan") is pleased to announce more analytical results from our 2025 maiden drilling program at the Company’s satellite West Santa Fe project, located only 13 km from Lahontan’s flagship asset, the Santa Fe Mine project, in Nevada’s prolific Walker Lane. These assay results are from two additional reverse-circulation rotary (“RC”) drill holes at West Santa Fe and are summarized below. The results from the final drill hole in the program are expected shortly.

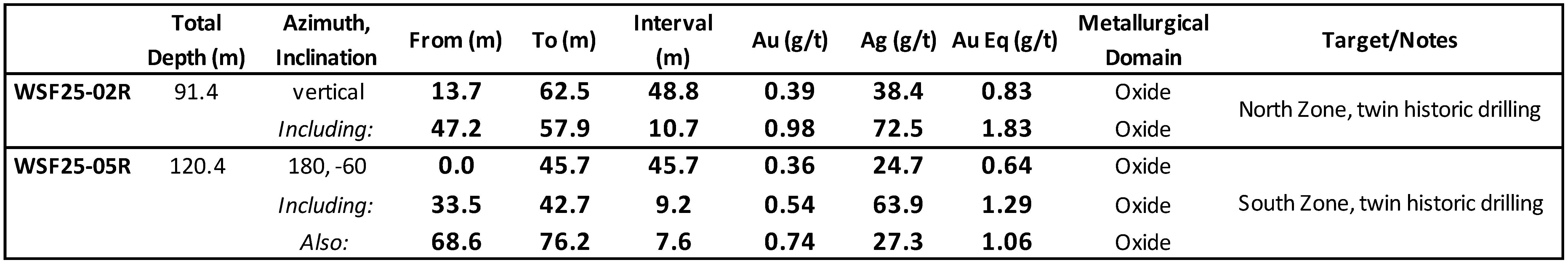

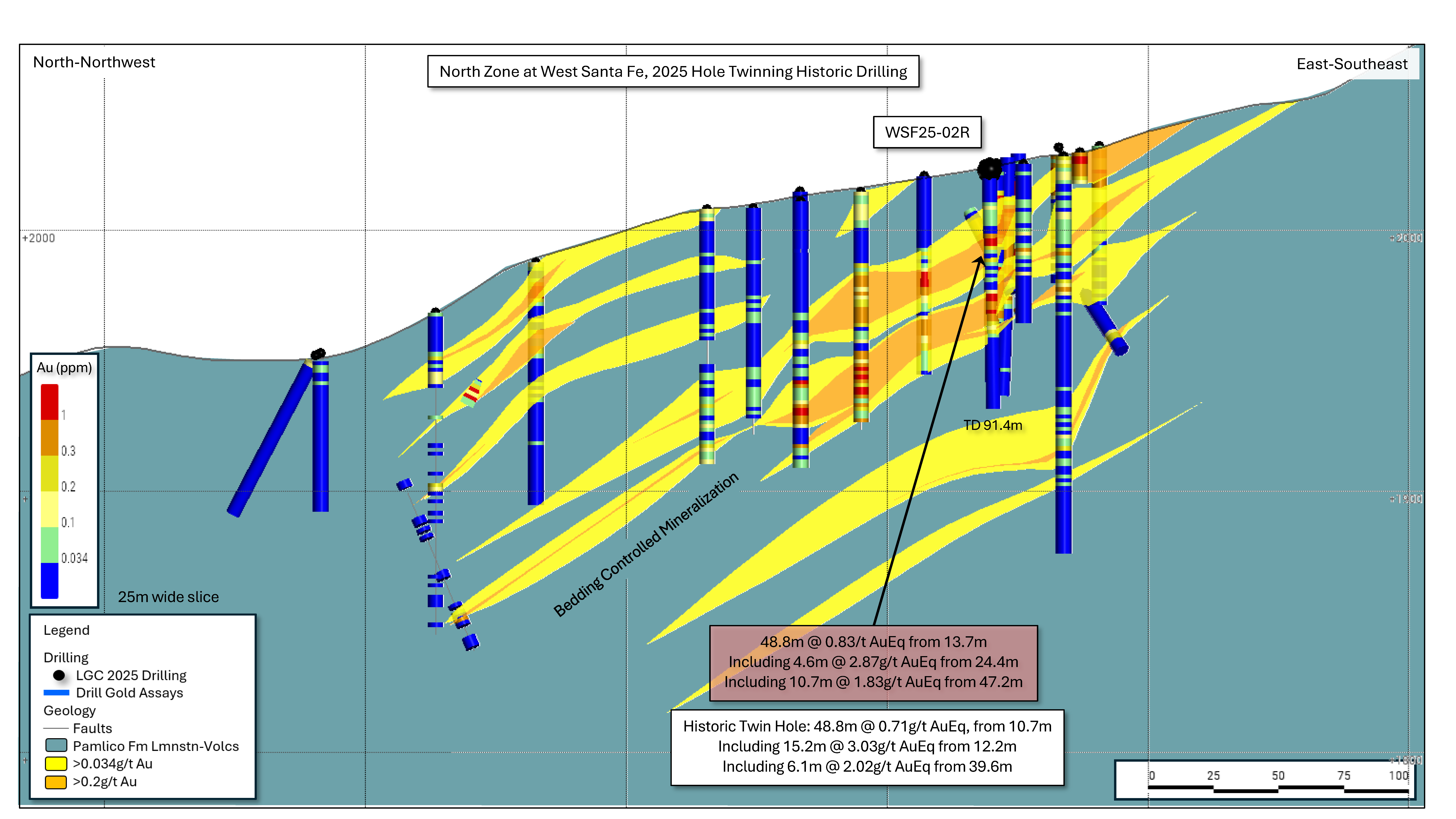

- WSF25-02R: 48.8 metres (13.7 – 62.5m) grading 0.83 g/t Au Eq including 10.7 metres (47.2 – 57.9m) grading 1.83 g/t Au Eq, a very shallow intercept of oxide gold and silver mineralization that shows excellent continuity with adjacent Lahontan drilling and historic drilling.

- Individual intercepts range up to 3.21 g/t Au Eq (1.52m, 25.91 – 27.43m, 2.08 g/t Au, 72.5 g/t Ag), similar in tenor to adjacent drill holes (please see cross section below).

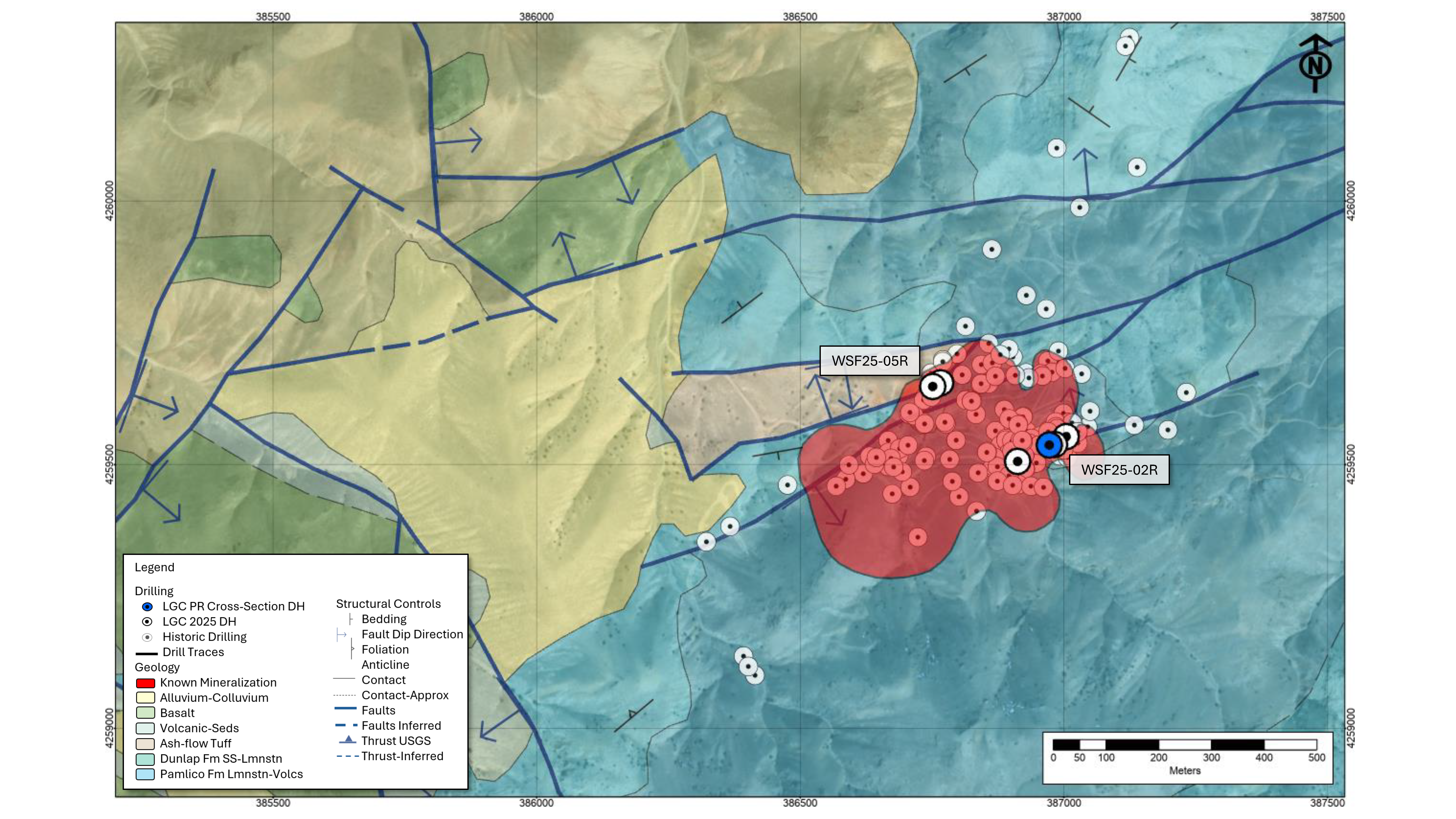

- WSF25-05R: 45.7 metres (0 – 45.7m) grading 0.64 g/t Au Eq. Oxide gold and silver mineralization beginning at the surface and correlates with adjacent Lahontan drill hole WSF25-06R.

- The intercept includes 9.2m (33.5 – 42.7m) grading 1.29 g/t Au Eq

- This drill hole is the northernmost completed by the Company and precious metal mineralization remains open to the north and west (please see plan map below).

Notes: Au Eq equals Au (g/t) + ((Ag g/t/60)*0.70). Silver grade for calculating Au Eq is adjusted to consider estimated metallurgical recovery reported by Kappes Cassiday (1982). True thickness of the intercepts is estimated to be 75-90% of the drilled interval. Numbers may not total precisely due to rounding.

Kimberly Ann, Lahontan Executive Chair, President, CEO, and Founder commented: “The drill results reported today confirm the northern extent of precious metal mineralization at West Santa Fe, and, when combined with the results from other Lahontan drill holes, now confirm gold and silver mineralization with a surface expression of 500 by 350 metres. Based on drilling to date, the thickness of the mineralization varies from about 35 to almost 60 metres, although folding may increase this thickness. The Company has multiple drill sites permitted west, north, and east of this central, outcropping, mineralized zone. Its early days and we are just beginning to identify the extents of the West Santa Fe system and understand the controls to both high-grade mineralization and disseminated, bedding controlled, gold and silver mineralization. We look forward to releasing the final results from the 2025 drill program shortly; planning is underway for follow-up drilling.”

Cross section through drill hole WSF25-02R, West Santa Fe project, Nevada. The results from this drill hole compare favorably with historic drilling, both in the grade of gold mineralization and the geometry. The gently dipping geometry of the mineralized zone may allow for inexpensive, low strip ratio, open pit mining in the future.

Drill hole location map for WSF25-02R and -05R West Santa Fe Project, Nevada. The surface projection of known mineralization, based on historic drilling, is shown in red, now confirmed by Lahontan drilling.

QA/QC Protocols

Lahontan conducts an industry standard QA/QC program for its core and RC drilling programs. The QA/QC program consisted of the insertion of coarse blanks and Certified Reference Materials (CRM) into the sample stream at random intervals. The targeted rate of insertion was one QA/QC sample for every 16 to 20 samples. Coarse blanks were inserted at a rate of one coarse blank for every 65 samples or approximately 1.5% of the total samples. CRM’s were inserted at a rate of one CRM for every 20 samples or approximately 5% of the total samples.

The standards utilized include three gold CRM’s and one blank CRM that were purchased from MEG, LLC of Lamoille, Nevada (formerly Shea Clark Smith Laboratories of Reno, Nevada). Expected gold values are 0.188 g/t, 1.107 g/t, 10.188 g/t, and -0.005 g/t, respectively. CRM’s with similar grades are inserted as the initial CRM’s run out. The coarse blank material comprised of commercially available landscape gravel with an expected gold value of -0.005 g/t.

As part of the RC drilling QA/QC process, duplicate samples were collected of every 20th sample interval at the drill rig to evaluate sampling methodology. Samples were collected from the reject splitter on the drill rig cyclone splitter. Samples were collected at each 95- to 100-foot (28.96 - 30.48m) mark and labeled with a “D” suffix on the sample bag. No duplicates were submitted for core.

All drill samples were sent to American Assay Laboratories (AAL) in Sparks, Nevada, USA for analyses. Delivery to the lab was either by a Lahontan Gold employee or by an AAL driver. Analyses for all RC and core samples consisted of Au analysis using 30-gram fire assay with ICP finish, along with a 36-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Tellurium or 50-element analyses were performed on select drill holes utilizing ICP-MS method. Cyanide leach analyses, using a tumble time of 2 hours and analyzed with ICP-AES method, were performed on select drill holes for Au and Ag recovery. AAL inserts their own blanks, standards and conducts duplicate analyses to ensure proper sample preparation and equipment calibration. We have all results reported in grams per tonne (g/t).

About Lahontan Gold Corp.

Lahontan Gold Corp. is a Canadian mine development and mineral exploration company that holds, through its US subsidiaries, four gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan’s flagship property, the 28.3 km2 Santa Fe Mine project, had past production of 359,202 ounces of gold and 702,067 ounces of silver between 1988 and 1995 from open pit mines utilizing heap-leach processing. The Santa Fe Mine has a Canadian National Instrument 43-101 compliant Indicated Mineral Resource of 1,539,000 oz Au Eq (48,393,000 tonnes grading 0.92 g/t Au and 7.18 g/t Ag, together grading 0.99 g/t Au Eq) and an Inferred Mineral Resource of 411,000 oz Au Eq (16,760,000 grading 0.74 g/t Au and 3.25 g/t Ag, together grading 0.76 g/t Au Eq), all pit constrained (Au Eq is inclusive of recovery, please see Santa Fe Project Technical Report and note below*). The Company plans to continue advancing the Santa Fe Mine project towards production, update the Santa Fe Preliminary Economic Assessment, and continue drilling the West Santa Fe project during 2026. For more information, please visit our website: www.lahontangoldcorp.com

* Please see the “Preliminary Economic Assessment, NI 43-101 Technical Report, Santa Fe Project”, Authors: Kenji Umeno, P. Eng., Thomas Dyer, PE, Kyle Murphy, PE, Trevor Rabb, P. Geo, Darcy Baker, PhD, P. Geo., and John M. Young, SME-RM; Effective Date: December 10, 2024, Report Date: January 24, 2025. The Technical Report is available on the Company’s website and SEDAR+. Mineral resources are reported using a cut-off grade of 0.15 g/t AuEq for oxide resources and 0.60 g/t AuEq for non-oxide resources. AuEq for the purpose of cut-off grade and reporting the Mineral Resources is based on the following assumptions gold price of US$1,950/oz gold, silver price of US$23.50/oz silver, and oxide gold recoveries ranging from 28% to 79%, oxide silver recoveries ranging from 8% to 30%, and non-oxide gold and silver recoveries of 71%.

Qualified Person

Brian J. Maher, M.Sc., CPG-12342, is a “Qualified Person” as defined under Canadian National Instrument 43-101, Standards of Disclosure for Mineral Projects, and has reviewed and approved the content of this news release in respect of all technical disclosure other than the Mineral Resource Estimate as noted above. Mr. Maher is Vice President-Exploration for Lahontan Gold and has verified the data disclosed in this news release, including the sampling, analytical and test data underlying the disclosure.

On behalf of the Board of Directors

Kimberly Ann

Founder, CEO, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email:

Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. Except for statements of historical fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedar.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/984721c0-79fe-4bad-8451-82e753a2ba38

https://www.globenewswire.com/NewsRoom/AttachmentNg/5a19cb10-21c8-4fb7-89b4-339d5a858cad

https://www.globenewswire.com/NewsRoom/AttachmentNg/44f5106c-4d16-45a0-a8d4-ee6ab740e6cd